OP Financial(1140.HK) Announces Annual Results for the Year Ended 31 March 2016

类型:Corporate News

Type:Corporate News

时间:2016-06-27

Time:2016-06-27

OP Financial Investments Limited (together with its subsidiaries, “OP Financial” or the “Group”), an investment company listed on the Main Board of Hong Kong Stock Exchange (Stock code: 1140.HK), today announces its annual results for the twelve months ended 31 March 2016 (the “Year”).

NAVpershareup5.9%toHK$1.43pershare

Profit for the Year amounted to HK$44.16 million

HK$1.67billionofcashonBalanceSheet

ProposedfinaldividendofHK2.5centspershare

The Group’s net asset value (“NAV”) increased to HK$1.43 per share as of 31 March 2016 (31 March 2015: HK$1.35 per share). OP Financial recorded a profit for the Year of HK$44.16 million (31 March 2015: a loss of HK$2.95 million), which was mainly attributable to the positive returns from the disposal of Zhonghui and Technovator, redemption of an incubated fund and share of results of CSOP.

The Group’s cash position increased significantly to HK$1.67 billion (31 March 2015: HK$513.38 million) due to positive investment returns and the completion of its placement of 900 million ordinary shares during the Year. The net proceeds from the placing were approximately HK$1.32 billion.

The Board of Directors recommended the payment of a final dividend of HK 2.5 cents per share.

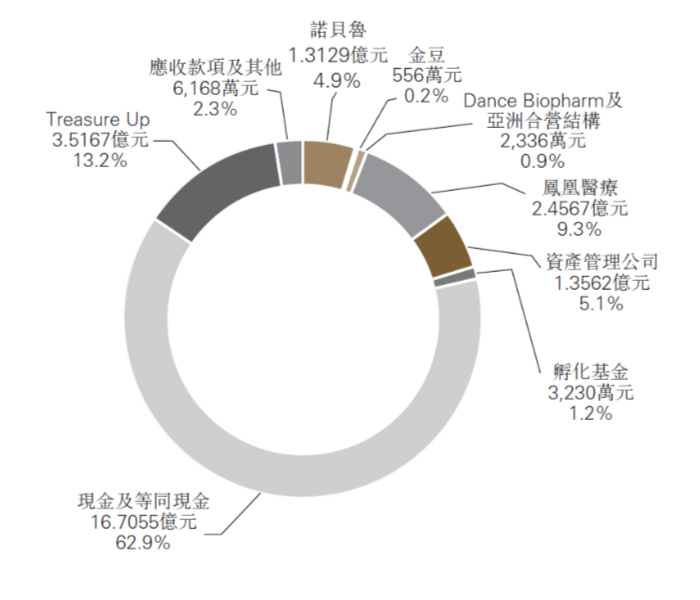

Investment Portfolio

As of 31 March 2016, OP Financial’s portfolio and core investments are as follows:

Investment Holdings by Source

(HK$ millions, as a percentage of total assets)

CSOP - CSOP Asset Management Limited (“CSOP”) is a market leader in RQFII ETF market. Its ETF products accounted for about 65% of all RQFII ETFs in terms of AUM. The carrying value of the Group’s CSOP position was HK$104.68 million as at 31 March 2016. Taking into account the dividend distributions up to May 2016, it represents a 13.42% year-on-year increase and exceeds 2.5 times the Group’s initial investment cost.

OPIM – OP Investment Management Limited is an asset management platform which serves Asian-based managers to develop emerging funds across diversified strategies. It has partnered with several PRC fund managers to expand their product base offshore and fulfill onshore investors’ demands in global allocation. During the Year, The Group’s investment position in OPIM increased to HK$23.89 million.

Nobel – Nobel Holdings Investments Limited is OP Financial’s co-investment with China Investment Corporation. Brent Oil price dropped below US$40 per barrel at the end of 2015, down more than 60% from the high in the summer of 2014. The oil price at its current level has exerted significant pressure on oil production companies. The fair value of Nobel dropped from HK$162.06 million to HK$131.29 million.

Treasure Up - OP Financial invested a total of US$45.17 million in 25% of equity interest in Treasure Up Ventures Limited (“Treasure Up”), which participated in a 15.3% investment in Beijing International Trust Co., Ltd. (“BITIC”). BITIC is a leading trust company engaging in trust and investment fund business in China. The investment creates synergies with OP Financial’s investments in financial services platforms.

Zhang Gaobo, Chief Executive Officer of OP Financial, commented: “We achieved satisfactory performances through divestment from three projects last year. We believe 2016 will be a fruitful year for our cross-border investment business, as Chinese companies continue to intensify their efforts in overseas mergers and acquisitions. A large number of PRC listed companies turn to Hong Kong for financing since China has strengthened capital control. This gives OP Financial an excellent opportunity for market penetration.”

Zhang continued: “Our expertise in cross-border transactions and financing makes us the best partner for PRC listed companies. We will concentrate on industries with huge potentials, such as finance, general health, modern services, high-end manufacturing and new energy, or industries lacking development, especially where efficiency can be rapidly improved through internet technologies. Meanwhile, we will also focus on financial platforms generating stable returns and creating synergies.”