OP Financial(1140.HK) Announces 2015/2016 Interim Results NAV per share increases to HK$1.43 per share Profit for the Period amounts to HK$44.71 million

类型:Corporate News

Type:Corporate News

时间:2015-11-27

Time:2015-11-27

(Hong Kong, 27 November 2015) OP Financial Investments Limited (together with its subsidiaries, “OP Financial” or the “Group”, Hong Kong Stock Code: 1140.HK) today announced its interim results for the six months ended 30 September 2015 (the “Period”).

The net asset value (“NAV”) increased to HK$1.43 per share as of 30 September 2015 (31 March 2015: HK$1.35 per share, +5.9%). The main factors for the NAV increase during the Period were the profits from disposal of several investments and a strong performance in its asset management positions, which together offset a lower valuation in its oil and gas investment.

OP Financial recorded a net profit for the Period of HK$44.71 million (30 September 2014: net profit of HK$10.26 million), which is mainly attributable to realized profits distributed from the Zhonghui Project, redemption from an incubated fund, and the disposal of its position in Technovator International Limited. Among our investments, Zhonghui Project was an interim financing arrangement for the purchase of Zhonghui Plaza in Beijing. The Group recognized the distribution of HK$88.65 million on this project of which HK$66.82 million was recognized in the Period.

OP Financial’s cash position increased significantly to HK$2.26 billion (compared to HK$513.38 million as at 31 March 2015) due to positive investment returns and the completion of its placement of 900,000,000 ordinary shares during the Period. The net proceeds from the placing were approximately HK$1.32 billion.

Investment Portfolio

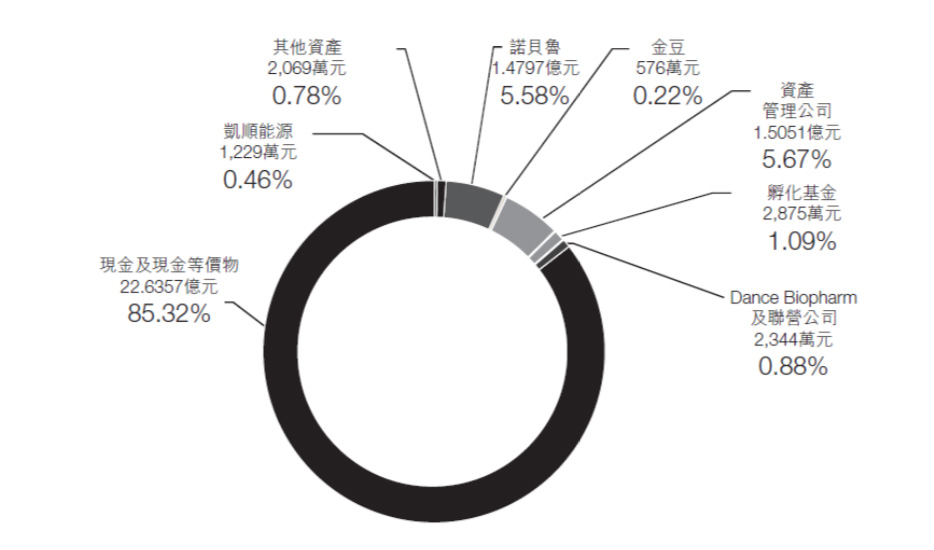

As of 30 September 2015, the fair value of OP Financial’s portfolio totaled HK$374.57 million (compared to HK$769.64 million as of 31 March 2015). Two core investments are as follows:

Investment Holdings by Source

(HK$ millions, as a percentage of total assets)

CSOP - CSOP Asset Management Limited holds the world’s largest Renminbi RQFII quota of RMB46.10 billion. During the Period, CSOP actively developed a wide variety of equal-weighted index ETF products, e.g. CSOP MSCI T50 ETF and CSOP China Chinext ETF. Leading the market with diversified product design, CSOP has earned increased recognition from international investors. The carrying value of the Group’s CSOP position was HK$132.60 million as of 30 September 2015. The Group received a distribution of HK$45.28 million from CSOP in May 2015.

Nobel – Nobel Holdings Investments Limited is OP Financial’s co-investment with China Investment Corporation, which is an independent upstream oil producer in Russia with principal assets include nine subsoil licenses covering seven oil fields and two exploration areas. During the Period, low crude oil price and tax reform policies in Russia exerted pressure on Nobel. The fair value of Nobel dropped from HK$162.06 million to HK$147.97 million.

Prospects

In the first ten months of 2015, Chinese investors made non-financial direct investment in 5,553 enterprises around 152 countries and regions, with an accumulative investment of RMB589.2 billion, up 16.3% year on year1. Mainland China’s small and medium-sized enterprises (“SMEs”) especially listed companies are becoming more aggressive in investing abroad, fast-tracking expansion efforts in 2015. This trend will continue as more SMEs learn to use mergers and acquisitions and joint ventures as an effective means to penetrate international markets.

Mr. Zhang Gaobo, Executive Director and Chief Executive Officer of OP Financial, comments: “China’s SMEs and listed companies are now actively investing overseas. There’s an opportunity to generate tremendous shareholder value by co-investing with them in cross-border assets, especially given our deep experience in cross-border transactions. Assisting in their endeavor to ‘going global’, we provide capital financing, deal structuring and corporate governance. For this reason, we’ve strengthened our capital and shareholder base to further our mission to become the best cross-border investment platform in the region.”